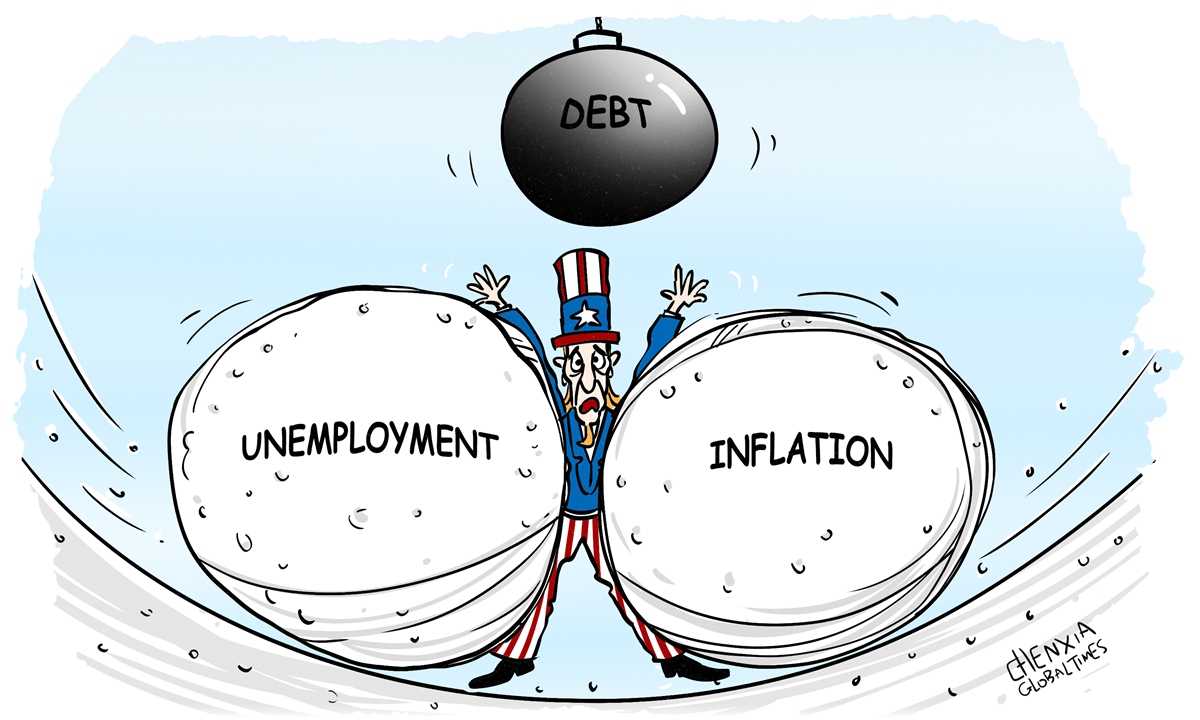

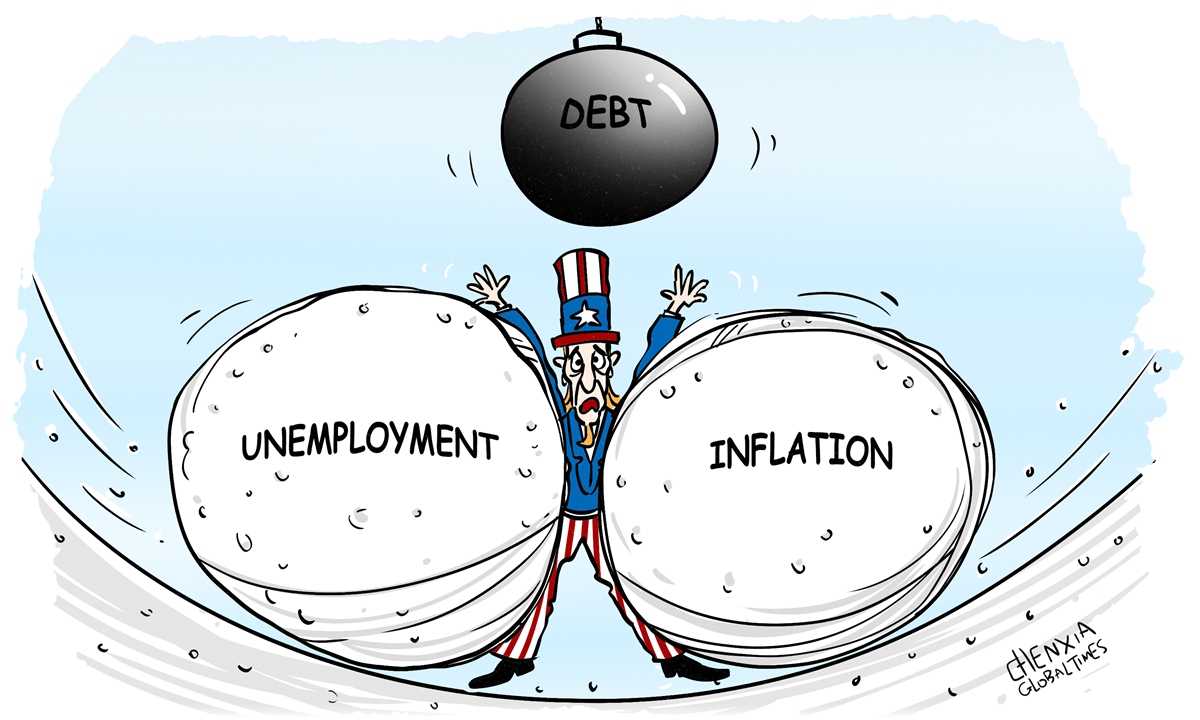

Illustration: Chen Xia/GT

US Federal Reserve officials are widely expected to leave interest rates steady at the conclusion of their two-day meeting on Wednesday,

but there are still many uncertainties. What's worse, the rising national debt may further complicate the situation. As the US remains the world's largest economy, any mistake it makes may have strong spillover effects that will harm itself and burden even the entire world.

The US federal government's total public debt has surpassed $35 trillion for the first time, as recorded at the end of last week, according to data released by the US Treasury Department on Monday. The growing debt will drive up interest payments.

Mounting interest costs have put tremendous pressure on the federal budget. In 2023, interest costs on the national debt totaled $658 billion - surpassing most other components of the federal budget, according to the Peter G. Peterson Foundation.

The Fed increased its federal funds rate 11 times between March 2022 and July 2023 in an effort to cool inflation. Since then, it's remained steady at 5.25-5.5 percent, a 23-year high. The federal funds rate is the benchmark for Treasury bills and other short-term debt securities. As interest rates on US Treasury securities rise, so too will the federal government's borrowing costs.

The high cost of borrowing is becoming a big problem. US policymakers are under increasing pressure to reduce borrowing costs, which could further complicate the issue of a Fed rate cut - a subject of hot debate.

The Fed faces a dilemma. Its mission to beat inflation back to its 2 percent target is not complete. Although inflation in the US, as measured by the change in the consumer price index, declined to 3 percent on a yearly basis in June from 3.3 percent in May, the economy needs to see more proof that the inflation beast has been tamed. That's why few experts expect the Fed to cut interest rates at its meeting this week.

However, if the Fed holds interest rates too high for too long, the US economy may lose momentum, as elevated interest rates will sap domestic demand.

High interest rates and other factors, including trade tensions, pose risks to an upbeat economic forecast. The American economy needs support. Many investors hope the Fed can cut interest rates as soon as possible.

A contradiction has emerged. Solving this big contradiction should be the main direction to improve the efficiency of US monetary policy, but this will not be easy. Any inappropriate policy decision could trigger a sudden eruption of financial risks that have accumulated from the Fed's aggressive rate hikes.

Against this backdrop, the unpredictability of US monetary policy is on the rise, which may bring uncertainties and challenges to the world economy.

The impact of rate changes comes with a long and variable lag. Spillover from the US situation is inevitable. US interest rate hikes have generated a spillover effect in the global financial market, resulting in a relentless rally in the US dollar and the depreciation of many other currencies. The world needs to be prepared for a new wave of "attacks" brought by rate changes in the US.

The uncertainty and unpredictability of US monetary policy reflect the inefficiency of its governance system. This has become a major source of risks to American economic growth and financial market volatility. The spillover impacts have been passed on to the world economy, threatening the global economic recovery and financial stability.

As the world has entered a period of uncertainty and volatility, only cooperation can help the world economy. Developing countries should get ready to cope with these forces and strengthen financial cooperation among themselves.

The author is a reporter with the Global Times. [email protected]乌白马角网原创文章,未经授权禁止转载。详情见转载须知。

文章点评: